First, it seems that since Brad Huebner and Rudy Coenen were indicted for fraud that some of the pumpers have suddenly become quite shy, while others have decided to drop the notion of a big RV. The popular theory now is that the dinar will be allowed to float. By speculating on a float the gurus can sidestep the legal quagmire of misrepresenting the CBI's currency reform plan. That was part of the case for fraud presented against Brad and Rudy. Instead the gurus can now just say that Iraq won't follow through with the CBI's plan but will float the IQD until it returns to its former valuation.

Before I continue let me review what was stated in the indictment. Under the "General Allegations" section we find the following:

7. The term "revaluation" (casually shortened to "RV" in dinar-sales parlance), refers to the contention that at some point in the near future, the dinar will rise against the U.S. dollar, a circumstance which will enrich earlier purchasers of the dinar. BRADFORD HUEBNER, CHARLES EMMENECKER, RUDOLPH COENEN and MICHAEL TEADT repeatedly advanced claims to potential investors over the telephone, through web pages, and through a weekly internet conference call that even relatively small investors in the dinar would, following the "revaluation" or "RV", become wealthy overnight.

8. A "redenomination" of the dinar refers to an actual proposal by the Central Bank of Iraq, announced as recently as June 21, 2011, to re-print the currency to remove three zeroes from the physical dinar banknotes as a matter of convenience. A redenomination of the Iraqi currency would not lead to a revaluation by the same amount, and may have no effect on the currency's value. Under a redenomination, a new currency replaces an old currency, but the value remains the same. Under the proposed redenomination, the Iraqi government would issue a new dinar note that will be equivalent to 1000 current dinars. The exchange rate would be 1.17 new dinars to the dollar, equivalent to 1,170 current dinars to the dollar.

http://www.realscam.com/attachments/f12/1576d1348185792-bayshore-capital-investments-bh-group-bhgroup_indictment.pdf

Some dinarians have read this and still cling to the big RV fantasy, dismissing the wording in the indictment as "smoke". Folks, you don't put a case like this together without making sure it's solid. If there was any chance that Iraq would revalue their currency to any substantial amount the prosecution wouldn't have included any reference to it in the case for fraud IMO. They would just prosecute them on the hedge fund and money laundering stuff.

So we can see here that in the case for fraud the indictment lists the misrepresentation of the CBI's proposal to remove three zeroes (a redenomination or "lop") as an RV that will make investors wealthy overnight. Some of these gurus took notice and quit saying that we're gonna be rich when they remove the zeros. Thus the float theory.

The problems with the float theory are numerous. First of all, countries as unstable as Iraq don't float their currencies as a rule. It would hurt their economy to subject the dinar to the volatility that a free float would present.

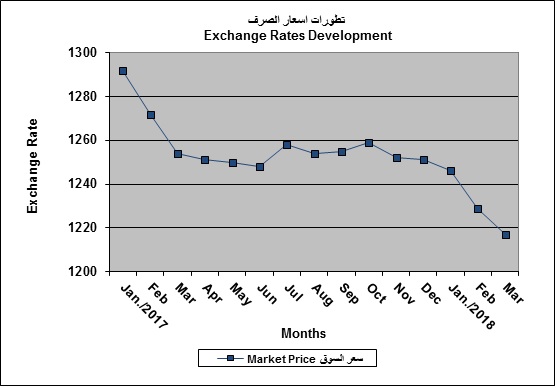

Secondly, nothing in Iraq's history suggests that the official value of the dinar is being artificially held down. To the contrary, it appears that it is being propped up considering the difficulty Iraq has had in keeping the market price in the same ballpark as the official value as it fluctuates from 1200-1300 IQD to the dollar. The often touted story from 2004 about the CBI buying back dollars with dinar to keep the dinar from appreciating too much was a reference to the market price, not the official value. Remember, the IQD is pegged to the USD so the official value can't appreciate apart from a decree from the CBI. It has been eight years since they had any concerns about the market price going too high in Iraq. The problem now is the value going too low.

Additionally, a float does nothing to reduce the money supply, which is the reason the dinar's value is so low in the first place. Until the money supply is significantly reduced a float would likely result in depreciation rather than appreciation.

It is my belief that when the CBI makes a reference to floating the value of the dinar they're either talking about a managed float of a few % with the official value or they're talking about raising the market price via the auctions by manipulating the money supply within Iraq. They have no intention of putting the dinar on a free float in the international market IMO.

Another issue that keeps coming up is the Feasibility Study from the Ministry of Planning in Iraq. Supposedly this study shows us the real value of the dinar at $3.20 but they can't come right out of the gate that high. They need to RV to something like $1.13 and then slowly float up to $3.20.

I would like to put this Feasibility Study/Justification Report nonsense to rest once and for all. It has nothing to do with the IQD. It refers to the official value of the dinar as $3.20 but the dinar's official value has been less than a tenth of a penny since 1995 according to the CBI website, so it has to be at least 17 years old. I think you'll find that the study was published in 1984 and revised in 1990 regarding the old Saddam dinar (thanks to Brian for the info on this).

From the website for the Ministry of Planning we read:

In turn, The Guidance For Technical And Economic Feasibility Studies And Post-Project Assessment Of Development Project (Regulations No. 1 for the Year of 1984 and it’s amendment for the year of 1990) has specifies a series of steps to be undertaken, which lead to the completion of a Capital Budget.

Then if you click on the 7th link that says "The Exchange Rate of Foreign Currency in Economic Feasibility Studies" you will find the study in question.

The real value of the IQD is not $3.20. It's not $1.13. It's not $.86. It's a tenth of a penny. According to the CBI website's financials there's 72 trillion dinar in the M2 money supply. This study was conducted when Iraq's money supply was measured in the billions, not trillions, so it makes no sense to base any analysis or investment decisions on anything in this report.

Then there's the dong. When all else fails pump the dong. Think about it, folks. Vietnam has had over 35 years to raise the value of their currency. And it keeps going down. Why? Because they want it to, that's why.

"The government has pushed to lower the value of the Dong in the hopes of pushing up exports and fostering export oriented economic growth (also referred to as export led development)."

Vietnam's economy is growing, and countries with emerging economies like this prefer a depreciating currency to an appreciating one so that they can pay their debt with cheaper currency and increase their exports.

Prior to the 1970s most mortgages in the US were fixed-rate mortgages. In other words, the homeowner paid the same interest rate for the duration of the mortgage. When double-digit inflation hit in the late 70s many homeowners were paying 7 or 8% interest on homes that were appreciating at nearly 15% a year and interest rates were higher than that. Lenders were losing money and the homeowners were loving every minute of it because they were paying off the mortgage with cheaper dollars on a home that was rapidly increasing in value. Lenders were actually bribing them to refinance. This is what led to the emergence of ARMs (Adjustable Rate Mortgages). Lenders wanted to cover their arses in the event of an unforseen recurrence of high inflation.

In the same way countries like Vietnam can pay their bills with cheaper currency by allowing it to depreciate somewhat, so long as it doesn't get out of control. The only reason Vietnam would have for raising the value of their currency is if inflation was a concern like it was in Iraq from 2006-2009 when they were raising the value of the IQD by about 9% a year. Believe it or not neither Iraq, Vietnam, nor any other country is going to raise the value of their currency just to put wads of cash in the pockets of speculators. That's a shocker, huh?

There's a few other topics being bandied about in the dinar world like Ban Ki-moon and Chapter 7 (irrelevant), and the Kurds (ditto). Breitling is telling people that Germany's currency returned to its pre-war value in eight years so Iraq is dragging their feet a bit. In fact the German deutschemark didn't "return" to anything. It replaced the pre-war currency the German reichsmark in 1948 so any notion that a currency can return to its pre-war value without a redenomination isn't supported by the history of the deutschemark. FootForward is telling people that hedge funds drove the Kuwaiti dinar up to $9 after the Kuwaiti "RV" in 1991 which is about as accurate as his World Series prediction. BGG is still talking about Maliki, Shabibi, Barzani, Talabani, Allawi and everybody else in the GOI and CBI who might have something to do with Iraq's currency reform, as if any of this is going to lead to substantial profits for any of BGG's listeners. And the dinar? Well, last I checked it hasn't done diddly. That's a shocker too, huh? I actually thought that removing Shabibi might bring about some increase in the dinar's value but it looks like his replacement is content to leave it be.

This is the time of year when gurus traditionally start setting dates and telling everybody it's going to be a very Merry Christmas and a very prosperous New Year (read BIG RV!!!). And of course the holidays come and go and ..... nada! Just a reminder of what to expect.

Last year I wrote a post called A Letter to Santa in which I asked to see some pumpers go to jail. Well Santa delivered four indictments in September so he's halfway there. Good job, Santa! Now I am making the same request this Christmas. How about a few more indictments in 2013? You can do it, you jolly old elf! I know you can!

Merry Christmas everybody!

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)