In the first video (above) Shabibi states that prior to 2003 Iraq had hyperinflation which led to a depreciated currency. They also had sanctions, low oil output, high unemployment, and an underdeveloped infrastructure. So when Saddam was removed and the coalition government and military forces began the transition to a democracy and a free market economy, there was a need for economic stability. Without stability it's hard to define or accomplish your objectives. That stability would be characterized by a stable exchange rate, low inflation, and an orderly payment system. By accomplishing their objectives, the CBI had paved the way for the Iraqi government to rebuild the country by attracting foreign investment.

In the second video he states that Iraq is rich in oil, but not in development, so they need to bring investors into the country to develop it. He then states that the growing foreign currency reserves are being used to provide stability which is good for the government and for investors. Pressure from within Iraq to use the reserves for certain projects and pressure from outside of Iraq (exogenous factors) to devalue their currency have been resisted in order to maintain economic stability. He feels that this stability will continue which will provide the right environment for foreign investment for the foreseeable future. At the end of the video he was asked about a potential revaluation of the dinar.

He answered that question in the third video by saying essentially that they might raise the value if inflation becomes an issue again. Half a year later that happened when coalition forces left Iraq and turned in their dinar for their respective nations' currencies, causing a spike in inflation due to the forces of supply and demand. The CBI's response in January of 2012 was to adjust the exchange rate from 1170:1 to 1166:1, raising the value 1/3 of 1%. Contrary to the mythical RVs of the dinar gurus, this is how revaluations usually work. Shabibi also mentioned that factors like imports/exports and balance of payments could determine the need for revaluation. Apparently they haven't been a problem since he said that.

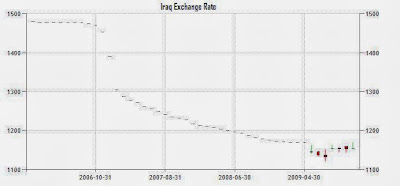

What many gurus have never told dinar investors is that the value of the dinar increased from Nov. 1, 2006 to Jan. 1, 2009 a total of 20% because of a policy change at the CBI. They went to a crawling peg for 26 months in order to bring the inflation rate down to a tolerable level. That 20% increase had nothing to do with increased oil production, GDP, growing currency reserves, or how popular the dinar was. It was a monetary policy change to bring down inflation and nothing more, and it worked. Once inflation settled below 10% they went to a policy of exchange rate stability which they have been on for nearly five years now.

Two years ago I did a post called Dinar Fact Sheet where I showed a document purportedly from the U.S. Treasury stating: "From 2006 to 2008, the CBI allowed the currency to appreciate by about 20 percent, primarily as a way to combat inflation". This was confirmed in an IMF document I've referenced several times which stated: "The central bank followed a policy of exchange rate stability which has translated in a de facto peg of the exchange rate since early 2004. However, from November 2006 until end 2008, the CBI allowed the exchange rate to gradually appreciate. As a result, the exchange rate arrangement of Iraq was reclassified to the category of crawling peg effective November 1, 2006. Since the start of 2009, the CBI returned to its earlier policy of maintaining a stable dinar."

Since the main factor in raising the value 20% during that time was high inflation there's really no reason to conclude that the IQD will increase in value any time soon unless inflation becomes a concern again by climbing back up to 10% or more. Currently inflation in Iraq is quite low as the chart above indicates.

Later in the video Shabibi was asked to comment on the news articles about "cutting the zeros". He referred to it as "redenomination". He responded that there was a lot of criticism of the proposal .... "all kind of talk". He said that some critics of cutting the zeros feel that it will lead to depreciation of the currency. That's odd, huh? Why would critics think that raising the value 100,000% would cause depreciation of the currency? Well the fact is the critics know that the proposal isn't a revaluation but a redenomination as Shabibi clearly stated, and history shows us that sometimes currencies depreciate soon after a redenomination. (The Turkish Lira, for example, depreciated for three years following the 2005 redenomination.) Thus the crtics' concern. He went on to say that it was just being done to "facilitate payment", meaning that it makes cash transactions easier. (The same fact sheet I mentioned above stated that "Under the proposed redenomination, the Iraqi government would issue a new dinar note that will be equivalent to 1000 current dinars. The exchange rate would be 1.17 new dinars to the dollar, equivalent to 1,170 current dinars to the dollar", which would certainly qualify as "facilitated" or "easier" since one dinar would then be able to purchase what 1,000 dinar purchased prior to redenomination.) He also mentioned "ease of counting" but said nothing about an increase in purchasing power being caused by the proposal.

Shabibi then gives us a brief history lesson, saying that the zeros were added because of inflation back in the 80s. That's when the money supply went from billions to trillions in Iraq. He says that conditions are different now and they have decided to go ahead with this plan to "bring back the Iraqi dinar" by removing the three zeros that were added because of past hyperinflation. So according to Shabibi, "bringing back the Iraqi dinar", "cutting the three zeros", and "redenomination" all mean the same thing. He then adds that before that can happen they need to educate the people and they need the violence in the country to subside so that the security forces can assist in the implementation of the redenomination. Some of the gurus have siezed upon the word "propaganda" as if Shabibi inadvertently let it slip that they're trying to hide the fact that they're going to enact the largest revaluation in history. The fact is, the word "propaganda" originally had a neutral connotation. From Wikipedia:

"While the term propaganda has acquired a strongly negative connotation by association with its most manipulative and jingoistic examples (e.g. Nazi propaganda used to justify the Holocaust), propaganda in its original sense was neutral, and could refer to uses that were generally benign or innocuous, such as public health recommendations, signs encouraging citizens to participate in a census or election, or messages encouraging persons to report crimes to law enforcement, among others."

Or an upcoming currency change, perhaps?

So you can see here that Shabibi's use of the word "propaganda" wasn't necessarily indicative of anything covert or sinister. Even if he hadn't changed it to "advertisement" it would have been an appropriate description of the campaign to educate the public about an approaching redenomination. Some people will read RV into anything.

Shabibi then states that a redenomination would require help from security forces. Some have argued against the lop, insisting that there's no reason to delay it year after year if that's what they really intended to do. Well, actually there is. Since the redenomination was announced a couple of years ago violence has increased in Iraq. So have smuggling and money laundering. Those things require the attention of security forces which would be needed during a redenomination. To redenominate while things are so unstable in Iraq would weaken overall security to an intolerable degree. This isn't Sam saying this. It's Shabs. He hopes that "security forces become less busy with the violence issue so they can devote time for us".

In the fourth and final video, Shabibi repeats his concerns about inflation, and price/exchange rate stability. He concludes by answering a question about the "policy rate", which I believe to be essentially the same thing as the prime rate in the US. He says that the CBI is concerned about the banks charging high interest rates, so they have a problem with both the banks and the government.

Everything Shabibi talked about in these videos is contrary to what the gurus have been feeding us. Shabibi said nothing about raising the value 100,000%. He said that revaluation depends on inflation, and the history of the IQD tells us that raising the value to combat inflation only requires small adjustments that will probably not provide any profits for dinar investors. He said that cutting the zeros is a redenomination. He said Iraq needs a stable exchange rate in order to plan, to budget, and to attract investment into the country.

It seems clear to me what Shabibi was saying in these videos, and it also seems clear to me that the only justification for believing in a big RV is if everything Shabibi said here was "smoke". Given the fact that the IQD's value is still below a tenth of a penny two and a half years later I'd say that's not bloody likely.

.jpg)

.jpg)