In the first video (above) Shabibi states that prior to 2003 Iraq had hyperinflation which led to a depreciated currency. They also had sanctions, low oil output, high unemployment, and an underdeveloped infrastructure. So when Saddam was removed and the coalition government and military forces began the transition to a democracy and a free market economy, there was a need for economic stability. Without stability it's hard to define or accomplish your objectives. That stability would be characterized by a stable exchange rate, low inflation, and an orderly payment system. By accomplishing their objectives, the CBI had paved the way for the Iraqi government to rebuild the country by attracting foreign investment.

In the second video he states that Iraq is rich in oil, but not in development, so they need to bring investors into the country to develop it. He then states that the growing foreign currency reserves are being used to provide stability which is good for the government and for investors. Pressure from within Iraq to use the reserves for certain projects and pressure from outside of Iraq (exogenous factors) to devalue their currency have been resisted in order to maintain economic stability. He feels that this stability will continue which will provide the right environment for foreign investment for the foreseeable future. At the end of the video he was asked about a potential revaluation of the dinar.

He answered that question in the third video by saying essentially that they might raise the value if inflation becomes an issue again. Half a year later that happened when coalition forces left Iraq and turned in their dinar for their respective nations' currencies, causing a spike in inflation due to the forces of supply and demand. The CBI's response in January of 2012 was to adjust the exchange rate from 1170:1 to 1166:1, raising the value 1/3 of 1%. Contrary to the mythical RVs of the dinar gurus, this is how revaluations usually work. Shabibi also mentioned that factors like imports/exports and balance of payments could determine the need for revaluation. Apparently they haven't been a problem since he said that.

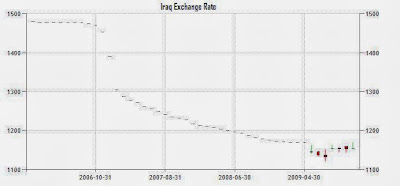

What many gurus have never told dinar investors is that the value of the dinar increased from Nov. 1, 2006 to Jan. 1, 2009 a total of 20% because of a policy change at the CBI. They went to a crawling peg for 26 months in order to bring the inflation rate down to a tolerable level. That 20% increase had nothing to do with increased oil production, GDP, growing currency reserves, or how popular the dinar was. It was a monetary policy change to bring down inflation and nothing more, and it worked. Once inflation settled below 10% they went to a policy of exchange rate stability which they have been on for nearly five years now.

Two years ago I did a post called Dinar Fact Sheet where I showed a document purportedly from the U.S. Treasury stating: "From 2006 to 2008, the CBI allowed the currency to appreciate by about 20 percent, primarily as a way to combat inflation". This was confirmed in an IMF document I've referenced several times which stated: "The central bank followed a policy of exchange rate stability which has translated in a de facto peg of the exchange rate since early 2004. However, from November 2006 until end 2008, the CBI allowed the exchange rate to gradually appreciate. As a result, the exchange rate arrangement of Iraq was reclassified to the category of crawling peg effective November 1, 2006. Since the start of 2009, the CBI returned to its earlier policy of maintaining a stable dinar."

Since the main factor in raising the value 20% during that time was high inflation there's really no reason to conclude that the IQD will increase in value any time soon unless inflation becomes a concern again by climbing back up to 10% or more. Currently inflation in Iraq is quite low as the chart above indicates.

Later in the video Shabibi was asked to comment on the news articles about "cutting the zeros". He referred to it as "redenomination". He responded that there was a lot of criticism of the proposal .... "all kind of talk". He said that some critics of cutting the zeros feel that it will lead to depreciation of the currency. That's odd, huh? Why would critics think that raising the value 100,000% would cause depreciation of the currency? Well the fact is the critics know that the proposal isn't a revaluation but a redenomination as Shabibi clearly stated, and history shows us that sometimes currencies depreciate soon after a redenomination. (The Turkish Lira, for example, depreciated for three years following the 2005 redenomination.) Thus the crtics' concern. He went on to say that it was just being done to "facilitate payment", meaning that it makes cash transactions easier. (The same fact sheet I mentioned above stated that "Under the proposed redenomination, the Iraqi government would issue a new dinar note that will be equivalent to 1000 current dinars. The exchange rate would be 1.17 new dinars to the dollar, equivalent to 1,170 current dinars to the dollar", which would certainly qualify as "facilitated" or "easier" since one dinar would then be able to purchase what 1,000 dinar purchased prior to redenomination.) He also mentioned "ease of counting" but said nothing about an increase in purchasing power being caused by the proposal.

Shabibi then gives us a brief history lesson, saying that the zeros were added because of inflation back in the 80s. That's when the money supply went from billions to trillions in Iraq. He says that conditions are different now and they have decided to go ahead with this plan to "bring back the Iraqi dinar" by removing the three zeros that were added because of past hyperinflation. So according to Shabibi, "bringing back the Iraqi dinar", "cutting the three zeros", and "redenomination" all mean the same thing. He then adds that before that can happen they need to educate the people and they need the violence in the country to subside so that the security forces can assist in the implementation of the redenomination. Some of the gurus have siezed upon the word "propaganda" as if Shabibi inadvertently let it slip that they're trying to hide the fact that they're going to enact the largest revaluation in history. The fact is, the word "propaganda" originally had a neutral connotation. From Wikipedia:

"While the term propaganda has acquired a strongly negative connotation by association with its most manipulative and jingoistic examples (e.g. Nazi propaganda used to justify the Holocaust), propaganda in its original sense was neutral, and could refer to uses that were generally benign or innocuous, such as public health recommendations, signs encouraging citizens to participate in a census or election, or messages encouraging persons to report crimes to law enforcement, among others."

Or an upcoming currency change, perhaps?

So you can see here that Shabibi's use of the word "propaganda" wasn't necessarily indicative of anything covert or sinister. Even if he hadn't changed it to "advertisement" it would have been an appropriate description of the campaign to educate the public about an approaching redenomination. Some people will read RV into anything.

Shabibi then states that a redenomination would require help from security forces. Some have argued against the lop, insisting that there's no reason to delay it year after year if that's what they really intended to do. Well, actually there is. Since the redenomination was announced a couple of years ago violence has increased in Iraq. So have smuggling and money laundering. Those things require the attention of security forces which would be needed during a redenomination. To redenominate while things are so unstable in Iraq would weaken overall security to an intolerable degree. This isn't Sam saying this. It's Shabs. He hopes that "security forces become less busy with the violence issue so they can devote time for us".

In the fourth and final video, Shabibi repeats his concerns about inflation, and price/exchange rate stability. He concludes by answering a question about the "policy rate", which I believe to be essentially the same thing as the prime rate in the US. He says that the CBI is concerned about the banks charging high interest rates, so they have a problem with both the banks and the government.

Everything Shabibi talked about in these videos is contrary to what the gurus have been feeding us. Shabibi said nothing about raising the value 100,000%. He said that revaluation depends on inflation, and the history of the IQD tells us that raising the value to combat inflation only requires small adjustments that will probably not provide any profits for dinar investors. He said that cutting the zeros is a redenomination. He said Iraq needs a stable exchange rate in order to plan, to budget, and to attract investment into the country.

It seems clear to me what Shabibi was saying in these videos, and it also seems clear to me that the only justification for believing in a big RV is if everything Shabibi said here was "smoke". Given the fact that the IQD's value is still below a tenth of a penny two and a half years later I'd say that's not bloody likely.

Search "Iraq news". The violence and bombings are getting worst everyday.

ReplyDeleteYou're right, Jay. And the worse the violence gets the longer they delay their currency reform, which unfortunately just encourages more people to dive into this scam thinking that the gurus' explanation of "delete the zeros" is correct. How ironic that the worse conditions get in Iraq the more hope it creates for certain speculators.

Delete"He then adds that before that can happen they need to educate the people"

ReplyDeleteOne of the funniest/saddest things in this scam is when you read dinar boards and they poke fun at Iraqis for being uneducated and stupid. Well… Iraqis get this, they know what a redenomination is and they know “delete 3 zeros” is a redenomination.

It’s the masses on dinar boards that are truly ignorant and sadly in a lot of cases simply stupid.

The douchebags insisted for so many years that "delete three zeros" meant taking the notes with 3 zeros on them out of circulation (an absurd notion even on it's face) that it just became an accepted fact in the dinar community. Even today, it's almost become a pre-qualifier for membership. "If you don't know what delete three zeros means then you're just not qualified to own dinar."

ReplyDeleteIt's much like the legend of the Kuwaiti dinar "revaluation" and Presidential Order 13303. If you lie about what those are for long enough then they just become accepted as something other than what they are. If you question them, you are automatically dismissed as someone with no credibility. After all, if you can't accept the premise of the scam, you're of no value to the people perpetuating the scam and you must be discredited.

Good stuff, Sam. As usual. I hope people are actually reading and watching the videos so they can hear, first hand, what Shabbibi actually said rather than getting it interpreted for them by the douchebags.

great read

ReplyDeleteSpot on Sam........Shabbs says straight up that Iraq is going to redenominate in those videos. Only the confused believe that he in anyway hinted towards a massive RV. Since there is no such thing as massive RVs and never will be then how on earth is Shabbs suppose to hint towards one? The man is an economist and would laugh at the notion of a 100,000% overnight currency appreciation. When the delusional "investor" asked him about a "RV" then Shabbs simply answered with actual economic fact which is slight currency appreciations to combat inflation and to balance other economic conditions not overnight get rich quick scheme impossible "RV" nonsense. Of course the believers point to the fact that Shabbs says "I couldn't tell you if I knew" as some kind of proof that the dinar will increase overnight by 100,000% to 300,000%. Really? Shabbs knows that himself or his central bank could or would never preannounce even a half of a percent increase in the dinar and that was all that he meant by the statement. These videos are nothing more than an economist talking ACTUAL economics which only the completely brainwashed in the world of dinar could spin into a massive RV.

ReplyDeleteThe arithmetically challenged solider on! Brought over from who knows where, posted on DV, Guru Doc (touted as being an "even keeled no hype guy") (see: http://dinarvets.com/forums/index.php?/topic/164453-sounds-more-reasonable-than-anything-else-ive-heard/#ixzz2j8F4gsPb

ReplyDelete) is quotes as saying:

"Secondly, to be strong, it must be implemented within proven macroeconomic principles. This is why the rumored high rates are preposterous. They would destroy Iraq economically.

This is why it is most probable reform will come in the form of some type of float to allow the currency to appreciate as the economic output of the country increases over time. We do not rule out some type of RV first but anticipate it to be in the order of a few cents or 10s of cents and not $3+ or higher."

So an increase of 3,500% to 35,000% (3 cents to 30 cents to match the few cents to few 10s of cents) is, according to Guru Doc, "within proven macroeconomic principles" but the next 10x step to 350,000% (to $3) is preposterous. Plus of course the fantasy that a rising economy implies a rising exchange rate. Classic.

Good find. You're exactly right. Dinarians lack simple math skills. That's what keeps this charade going. It's all about perspective. When $3 or $1 are bantied about all the time, it makes 10 cents seem perfectly rational. Now some of the clowns are throwing out $25 or $30 rates so 10 cents seems, not only reasonable, but downright conservative. Yet mathematically, 10 cents is just as ridiculous as $30. A rate of 10 cents values Iraq's money supply at $8.5 trillion. A rate of 1 cent values it at $850 billion. So a nation with a GDP of $210 billion can support a money supply valued at $850 billion (and that's if the dinar RVs to just 1 cent)? That seems reasonable? It only seems reasonable if you have absolutely no understanding of what you're talking about. A money supply 4 times higher than the entire annual output of the nation is impossible! Are you kidding me? It's absurd. Pure idiocy.

DeleteHere is a response from one of the sites: bash away

ReplyDeleteI am no economist, but I did some number crunching a while back and when you look at all of the factors, it does make sense. GDP is a part, money supply is a part as well, but there are other factors such as reserves, actual amount in circulation, etc. Their reserves are huge, much larger proportionally than the US holds. How much of the dinar is actually in circulation is an unknown factor. We can look at economic indicators such as their M2, but that does not tell us how much they have actually taken back in, how much is held in foreign reserves by countries like the US, or how much has actually been sold to investors. We can make some assumptions and estimates, but in the end, they are at best, good guesses. I don't have time now, but will try to dig up the info later, but IMO, an RV anywhere up to the $3.50 range is possible and reasonable. There are actually some pretty good reasons to expect an eventual value of the dinar in that range. There are also some wild cards that we just can't be sure of, but even if it lops and then RV's I believe we will see a decent profit.

You got one thing right: you (he) certainly are no economist, that's for sure.

Delete1. Their reserves are not huge relative to their money supply. Their reserves are enough to back the M2 fully at around 1,000 to 1. That's a fact.

2. Who says they've "taken any back in" besides the gurus, which are known to be complete liars? The CBI says they are not only not taking in, they're PUTTING MORE OUT. That's what their ever increasing M1 and M2 numbers mean. You can verify these numbers right on the CBIs own website.

3. How much dinar is in circulation is not an "unknown factor". There is zero reason to believe the CBIs numbers are significantly incorrect. There are MANY reasons to believe that they ARE correct, such as:

a. Hundreds of millons of dinar for sale on eBay on any given day

b. Dinar trade sold half a trillion dinar in 2011 alone. That's one company, in one year.

c. The CBI says it is so.

d. The CBI has been independently audited, I think if the CBIs numbers were off by tens of trillions you'd probably have seen some news regarding it.

e. Why would they keep selling it at 1166 if they'd removed so much of it that it should be worth substantially more?

f. If they've removed so much of it, why hasn't the street rate in Iraq gone up? The Iraqis don't even think it's worth 1166, the street rate is usually 1200-1300, yet you think it's worth more than 3,000x that much? Why do you think you know so much more about Iraq than Iraqis?

4. The UST says they essentially hold zero dinar in reserves, according to the charges filed against the BHG group. You have a better source that says otherwise? No, you don't. The notion that ANY country on the planet would want to hold on to billions of dollars worth of currency of a country that is violent and unstable and who's only output is oil (which is sold in USD) is completely ridiculous. It makes zero sense.

5. 3.50 is not possible and reasonable. It's ridiculous and insane. It makes zero sense whatsoever. It will never happen. The facts prove it. Their M0/M1/M2 proves it. The amount of dinar sold to suckers in the US alone proves it. There is literally zero reason to think the dinar will appreciate even 1,000% over the next decade, let alone the 300,000% overnight that you're saying is "reasonable".

6. If it lops it is far more likely you will see an additional sizable loss, rather than a decent profit. People talk about lopping and then going to 3 dollars like it's the worst case scenario, which is nonsense. It's more likely to lose 10% in value after a lop than gain 200%+. Look at other lops and you will see this is a fact. Add in the massive spreads that most people have already paid, plus the even more massive spreads that you'll likely have to pay in order to "cash in" after a lop, and you're practically guaranteed to lose 40% or more of your "investment".

Oh my goodness. How doe this even pass a smell test? Every single piece of data related to reserves, M0, M1, M2 is right on the CBI's website. GDP data is on Wikipedia and countless other locations. None of it is secret or subject to interpretation. You don't have to assume or estimate anything. You don't have to guess on anything. Unfortunately, this is the essence of this scam. The clowns rely on the ignorance of their followers and subscribers regarding foreign currency exchange. But it isn't that hard. If common sense doesn't already tell you it's preposterous, a simple mathematical calculation will do the trick. Iraq has produced approximately 85 trillion dinar (rounded). They fix the exchange rate of their currency to the US dollar. Iraq currently maintains $70-75 billion in foreign cash reserves (rounded, converted to US dollars). 85 trillion divided by 72.5 billion equals 1,164.38. Guess what the fixed exchange rate to the US dollar should be? About 1,164.38. Shazam! It's unbelievable how willfully deceptive these clowns can be. If Iraq's reserves suddenly jump to $255 trillion then I suppose you could suggest the dinar exchange rate with the dollar should "reasonably" be $3. But since $255 trillion is more than 4 times the value of the entire world's money supply, I don't think we have to worry about it for a few centuries. LOL!

DeleteBTW, gt5 is exactly right. Not only will dinar investors not make money on a lop, they'll lose even more money. If a new currency is issued, how are existing dinar holders going to get their hands on it before their existing notes become invalidated? They're not going to fly to Iraq to do the exchange. They'll get them the same way they do now. They'll use these "money service" businesses that will rape them for another 10-20% to exchange their old notes for the new notes. But they'll do it enthusiastically because the clowns will tell them that is the final step before the mythical RV. They'll hype it up beyond comprehension. So, so sad.

Are they referring to currency reserves or oil reserves? There is no conceivable way to justify $1 or more based on currency reserves. If they're assuming that the dinar is backed by oil reserves then maybe they could make the numbers work. That was a mistake that I made early on, but there is zero evidence that Iraq or any other country is going to back their currency with oil or anything else in the ground.

DeleteYep, that's one of the saddest parts to me right now. The prevalence of this scam has died down quite a bit since 2011 (traffic for dinar sites was typically down 95%+ since then, last time I looked), but it is nowhere near over.

DeleteEarliest Iraq seems likely to lop is 2015, and I wouldn't even give 2015 good odds. If I had to bet, I'd say there's only a 50/50 shot of it happening within the next 5 years. Which would mean five more years of the same old nonsense and lies.

And then, as you've said, the scam still isn't over. Most gurus will likely spin the lop as the RV they've been waiting for. You'll have people booking flights to Reno and handing over their dinar for receipts that are likely to be worthless or only worth pennies on the dollar. You'll have pumpers saying "hey, even though the RV already happened and the dinar is worth 86 cents each in Iraq, the rate hasn't "gone live" in the US yet, so you can still get some 25k notes from (insert unscrupulous dinar dealer here), better hurry!" That'll go one for at least a few months I'm sure.

Then when even the dumbest of the dumb start to wise up to that, the new lies will all be about the new dinar notes. "get them now, you're not going to get the 300,000% return that we hoped for before, but you'll almost certainly get 300%+, maybe as much as 3,000%!"

Then you'll probably come to the "lawsuit phase", which has happened with other scams (CMKX comes to mind). There will, of course, be legitimate lawsuits against gurus and dealers (already are some, in fact). But I almost guarantee there will be scam lawsuits as well. "The dinar was going to RV but the feds/obama/rothschilds/illuminati/space aliens/UST/etc stopped it, so we're going to sue them and get that 100,000% return! All you need to do is become a lawsuit VIP member, for the low low price of $399, and you too can get the return on your investment you earned!". Then of course you'll also need the OSL membership, for the Off Shore Lawyers in Iraq/Belize/Antarctica/etc, that ones 399 too. Then you'll have to sign up for OGAC, to be a part of the Operation Get A Class-action lawsuit team, that one's $999.

Even after a lop the scams will probably continue for years.

The idea of backing a currency with a commodity is just another myth. A central bank only needs to back a pegged currency and single industry economies like Iraq tend to not want to float as their economy is too volatile based on the price for that commodity. The reason a central bank that pegs, needs to keep sufficient foreign reserves to back their full money supply (at a minimum) is not (as folks at DV tend to "LOL" about) in case the entire money supply is exchanged, but to prevent that from happening. If a central bank pegs, they are the source of exchange. They can't force anyone to offer that same price and typically others offer less to cover the costs of upstream exchange with the central bank. It would be silly to take less than the central bank offers so they are the source of exchange (note that if exchange is restricted, as it is in Iraq with the requirement that dollars sold at the "auctions" are only for imports, secondary markets can get away with even less as there is no alternative). If the bank were to offer a rate that they could not cover for the entire supply, there would be an immediate run on the bank to get dollars while you could.

DeleteIn that in mind, what would being backed by oil (in the ground or otherwise) mean? Exporters in other countries are not going to want some sort of IOU for future oil as payment. Importers need dollars (or the currencies dollars can be exchanged for) and the only source is the CBI. Iraq in theory could sell a massive amount of oil futures, but both that huge amount and the risk of future delivery given Iraq's political and social situation would require Iraq to give a huge discount. Even then those funds are not owned by the CBI but the government. The only way the CBI gets additional reserves is by making money from the spread on IQD/USD exchanges and other fees.

Even ignoring the issue of the CBI vs GOI owning their oil, if a huge influx of cash were to somehow occur setting a higher exchange rate would be a terrible way to use it. If they want to help the Iraqi people (as some claim this is about, to "increase purchasing power"), they can just give the money or services away as is done by say Qatar. Altering the exchange rate is a terrible method to distribute wealth.

Good posts guys. As for "backing the Dinar with oil", it really doesn't work like that (and Iraq wouldn't want it to work like that). And even if it did, let's do the maths:-

Delete- Iraq currently exports about 2.07m barrels of oil per day. (It may produce more, but it doesn't export it all as a large chunk is obviously consumed domestically (oil power stations, domestic transportation, construction, etc):-

"Iraq exported 62.1 million barrels of oil in September, or about 2.07 million barrels per day (bpd), the lowest daily average since February 2012".

http://www.iraq-businessnews.com/2013/10/28/oil-exports-plunge-to-19-mth-low

- 2.07m barrels of oil per day x 365 days x $97 current oil price = $73.3bn annual oil export revenue. (Again we're being generous and assuming a 0% rate of corruption or "missing" oil).

- 84,000bn Dinar money supply divided by $73.3bn = 1,146 years. That's how long it would take Iraq to export enough oil to "back" just today's 2013 money supply 1:1 (assuming it doesn't create a single Dinar from now until 3,159AD). If you use the absurd 1:3 (1 Dinar = $3), then it would take Iraq from now to 5,451AD to sell enough oil to raise enough $ to "give" everyone $3 for each Dinar currently in circulation.

- But there's just one problem - 1,146-3,438 years x 2m barrels per day = 836bn-2509bn barrels of oil in total. But Iraq only has about 152bn barrels of proven oil reserves (of which only about 100bn will be exportable after domestic consumption)...

And all that's ignoring the fact that much of Iraq's oil revenue pays for their domestic govt budget, and is unavailable as FX reserves. Include that and you're talking virtual infinity since Iraq is already running a budget deficit ...

And that's the sheer stupidity of the "Iraq's $70bn oil income will 'support' an $84,000bn-$252,000bn 'RV'" in a nutshell.

OMG networth you just hit on something that I tried to verify with Dinar Banker or currently Sterling Currency Group. On a call I tried to get the butt face dealer confirm that they would guarantee exchanging the current triple notes at the going rate "IF" it did get to say $1 to 1IQD OR even exchange the current "000" notes with the new LOP'd notes 1-for-1 once the redenomination occurs but the moron just kept dancing around the question with a stupid response that I paraphrase "we guarantee you can exchange them with back through us. I can not guarantee you what the rate of the exchange may be, or what rate we will be exchanging it at." At no point did I ask for a rate. So I called and it appears that their answer is scripted which is no surprise to me. Ah, another thing they stated was they couldn't say that they believe a redonomination or revaluation could or would happen. Again not what I asked them to say. Just that they would guarantee they would provide either method of exchange. So there you have it. Their site simply says that they will exchange your currency which simply could AND most likely means that they would gladly buy back your currency at a loss to you. It's symantecs when it comes down to it. A play on words and if you're not witty enough to catch that you will continue to buy into their lies.

DeleteBasically I wanted to get something either on a recorded call or writing but they refused to do both.

Vinny,

DeleteSince I am the "butt face" and "moron" you were speaking of, let me see if I can answer your question in terms you will understand. I cannot offer advice nor opinion on the future value of any of the currencies I sell. That would constitute investment advice that I cannot provide without breaking the law. We will exchange any currency that we sell and will work with customers if the currency is re-denominated. I cannot guarantee a specific rate nor terms on a re-denomination which has not occurred. The staff at Sterling Currency Group follows the same policy as you have observed.

I personally choose not to speculate on the actions of the CBI with regard to the IQD whether re-denomination or any other action. I can see this disappoints you - enough that you resort to name calling in frustration. I am sorry for that, however you can goad me however you wish and that will not change.

All that said, yes we will exchange your currency even if you call us names, we will be competing with all other dealers in the market - if someone has a better deal for you by all means take advantage of it. The pricing and exact terms of that commitment will change with the market, however the good thing about markets is they generally allow choice for the consumer and that choice sets up competition in the market that will set the terms of the transaction.

Ok, there you go again making a claim and changing my words by alluding to me asking for a rate. I will repeat now as I did before AND the post above you responded to which states I DID NOT ASK ABOUT RATES!!! Let's see if you get it this time.

DeleteOn a separate note your statement of "We will exchange any currency that we sell and will work with customers if the currency is re-denominated." in and of itself is not specific as to whether Sterling WILL exchange triple zero notes for the newly redenominated notes thereby I stand by what I said - that it is semantics. For example: if I call a US bank and ask them if they will exchange a $1,000 note for smaller denominations ($100, $50, $20, $10, $5, $1) their answer would be yes. The question is the same for IQD therefore this has NOTHING TO DO with a rate so STOP twisting my question.

So to say that I am disappointed holds true when because you and your team could not answer a simple answer. If you won't provide a guarantee that you can't do that then it's fine but don't play my question off as being a rate question because you were wrong then and you're wrong AGAIN!! This is exactly why I felt uncomfortable purchasing any dinar.

I have nothing else to say to you because at this point you are irrelevant.

M2 is not an economic indicator, its a measure of the currency in circulation and includes all dinars out in the wild (i.e. not in the central bank). The Fed does not have to maintain a reserve as the US Dollar floats rather than being pegged. At $3.50 the value of the Iraqi money supply would be greater than that of the entire rest of the world combined, which is obvious can not happen. I away this "digging".

ReplyDeleteLOL........Man I wish every dinar dreamer would read this thread. Easyrider and Caz I am pretty sure read this blog and I know it just burns their arse to hear the truth. Of course they are too gutless to come here and whine like they do constantly to people speaking fact on their controlled censored scam ripoff site called DV. I can not wait for the day of the redenomination. Caz whines constantly saying that "lobsters" want a RD. Of course we do. We want this scam to finally come to an end so there are no more victims of the exact hype created by the likes of those two. They keep saying that "lobsters" don't want anyone to make money. Problem is there was never any possibility of that ever happening with the dinar from the start.

ReplyDeleteGO RD>>>>>>>

LOL.. "LOBSTERS" just want to eat sea urchins, plankton and small fish. It's what keeps them growing and going. ;-)

Delete