An article from Reuters entitled "MIDEAST MONEY-Iraq dinar is short-term disappointment, long-term bet" came out Wednesday and it confirms some of the things I've been saying for some time now. My comments will be added below.

BAGHDAD, Oct 3 (Reuters) - Many Iraqis have lost faith in their dinar

currency but to some foreign speculators, it promises big profits. The contrast

underlines the uncertainties of investing in Iraq as the country recovers from

years of war and economic sanctions.

The logic of the dinar bulls is simple. Iraq's oil exports rose to 2.6

million barrels per day in September, their highest level in three decades; the

country aims to hit 6 million bpd by 2017, which would put it close to Saudi

Arabia's current level.

Even if unstable politics, militant violence and bureaucratic inefficiency

prevent that target from being hit, Iraq still seems to be on the threshold of

an oil boom that will transform its finances.

Inflows of new oil revenue could give the country big external surpluses and

push state finances deep into the black by late this decade - the classic recipe

for a strong currency.

"As far as our investors are concerned, when they buy Iraqi dinars they do

know it is a long-term investment. You know it takes time for a country to

rebuild itself," said Hassnain Ali Agha, president of Dinar Trade, a U.S. dealer

of exotic currencies.

Because the dinar is not freely traded by banks outside Iraq, online dealers

of banknotes such as Dinar Trade are the only way that most foreigners can

invest in the currency. The Las Vegas-based company says it sells as much as

hundreds of thousands of dollars worth of dinars daily, shipping dinar notes to

thousands of customers in the United States and elsewhere.

Agha said that because of optimism about Iraq's oil wealth, there had been

solid demand for dinars since his company was founded in 2004, a year after the

U.S. invasion which triggered years of political violence and economic

turmoil.

Back in Baghdad, however, Iraqis themselves are not convinced. Many take what

opportunities they have to change their dinars into hard currency, and conduct

all but small day-to-day transactions in U.S. dollars.

"We have no trust in the Iraqi dinar - we feel afraid to save it. We trust

the dollar more. The dollar does not go up and down, it is fixed," said

housewife and mother-of-two Eman Saadeldine.

WILD SWINGS

The dinar has endured wild swings over the past three decades. In the 1980s,

one dinar bought around $3, but economic sanctions imposed on Iraq around the

time of the 1991 Gulf War sent the currency into decline and stoked inflation,

which the government fuelled by printing money. By late 1995, $1 bought as much

as 3,000 dinars.

After the 2003 invasion, the central bank intervened in the currency market

to strengthen the dinar, using its supplies of dollars to manage the exchange

rate.

But over the last several years, even as Iraq's oil production has expanded,

there has been none of the appreciation for which speculators have been hoping.

The central bank now sells dollars in daily auctions at a fixed price of 1,166

dinars, a level barely changed since 2009.

In fact, the dinar has recently faced downward pressure as a result of the

international economic sanctions imposed on neighbouring Iran and Syria. Iraqi traders

rushed to buy dollars to sell on illicitly to residents and businesses in those

countries, which are hungry for hard currency.

The dinar fell as low as 1,280 in the open market this year before Iraqi

authorities reacted by allowing two state-run banks and some private lenders to

sell dollars, helping push the exchange rate back to around 1,200

currently.

Another factor counting against the dinar is the fact that the largest

banknote is only 25,000 dinars. This often makes the currency unattractive to

use in an economy where the banking system is primitive and deals are often done

in cash.

Saadeldine recalls paying in cash for a new house in 2009.

"If our money had been in dinars, it would have been impossible for us to

carry it. It was in dollars and we carried it in a small suitcase," she

said.

The central bank has been considering plans to knock three zeros off the

nominal value of banknotes to simplify financial transactions. This would not in

itself increase the real value of the dinar, since prices would adjust in line

with the redenomination, but economic experts say it could improve confidence in

the dinar and thus boost its value eventually.

"It would increase trust in the dinar even though its value would not

change," said Baghdad-based economist Majid al-Souri. "Indirectly, when trust

increases there will be appreciation."

Earlier this year, however, the cabinet decided to suspend the technically

complex redenomination plan until further notice, saying the economic climate

was not suitable.

The biggest obstacle to dinar appreciation is the fact that for now at least,

Iraqi authorities appear content with the exchange rate in its current

range.

In a memorandum to the International Monetary Fund on economic and financial

policies for 2011, written in March that year, the Iraqi government said it saw

benefits in keeping the dinar stable.

"We believe that the policy of maintaining a stable exchange rate continues

to be appropriate, as it provides a solid anchor for the public's expectations

in an otherwise uncertain environment and in an economy with a still very low

level of financial intermediation," it said.

LONG TERM

In the long term, however, Iraq's finances and economy may improve so

dramatically that authorities feel comfortable allowing the dinar to appreciate

under the pressure of flows of oil money into the country.

The IMF expects this year's estimated budget surplus of just 0.2 percent of

gross domestic product to balloon to 12.1 percent in 2017. The country's balance

of trade in goods and services, in deficit as recently as 2010, is projected

over the next five years to shift to a large surplus of 11.3 percent of

GDP.

Deputy central bank governor Mudher Kasim told Reuters that he expected

redenomination of the dinar to go ahead in 2014 or later, by which time the

amount of Iraqi currency in circulation would have increased significantly,

making financial dealings in cash even harder.

In the long term, the central bank aims to make 1 dinar equal to $1 with a

combination of redenomination and appreciation, although that will take over

three years because of instability in the Middle East, Kasim said: "If not for

the regional circumstances, we would proceed faster with that plan."

Some analysts think the appreciation could go further. Kamal al-Basri,

research director at the Iraqi Institute for Economic Reforms, an independent

research body in Baghdad, said he expected the dinar to stay stable for the next

three years, but that afterwards it might strengthen beyond parity against the

dollar, including the effect of redenomination.

For that to happen, Iraqi politics will have to stabilise, skill and

education levels rise and the economy diversify so that it is not so heavily

dependent on oil exports, he said.

Speaking at the Baghdad currency exchange shop that he owns, Ahmed

Abdul-Ridha said the dinar's stability in the past three years was good, but it

did not indicate the long-term trend.

"We wish the dinar's value would go back to what it was like before, when it

used to equal $3 in the 1970s and even in the 1980s," he said.

"I expect that day will come. Why not? What we are going through is an

abnormal condition...We are an oil country."

http://www.reuters.com/article/2012/10/03/iraq-economy-dinar-idUSL5E8KT13720121003

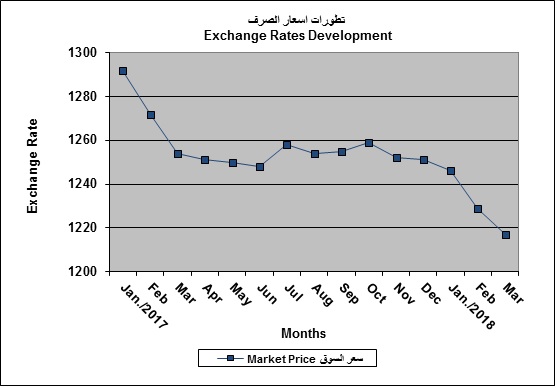

My first observation is that Iraqis are concerned about the volatility of the dinar. Now why should they be concerned? The dinar's value is pegged to the US dollar after all, and to my knowledge hasn't declined in value since it was introduced nine years ago. Well the fact is there are two values for the IQD - the official value and the market value. This is a foreign concept to Americans but in Iraq the street value can vary from the official value considerably. Take a look at this chart from the CBI website.

As you can see the Auction Price reflects the official exchange rate and the Market Price is the street price which has fallen considerably against the dollar this year. This is why the CBI had to step in recently to bring the street value closer to the official value, as was discussed in this article.

Majid picture, that the U.S. dollar in freefall and Sesawe Iraqi dinar exchange rate in the next few days, praising measures the central bank "successful" to reduce the dinar exchange rate against the dollar. said Suri (of the Agency news) today Sunday: One of the important factors for the high exchange rate of the dollar against the dinar in the summer months the past is the high demand and tight supply and exploitation of banking companies for citizens to raise the price of the dollar, prompting the central bank to increase supply in the currency auction. added: that the success of actions the central bank to reduce dollar against the dinar would make dollar equals Iraqi dinar per the next few days. confirmed the picture: the decline of the dollar was limited only to demand cash and not remittances, noting that the transfer obtained by the merchant through banks and banking companies circulated at the official rate, The cash demand by citizens through banking offices fell to its dependence on the supply and demand factor.

http://www.sotaliraq.com/mobile-news.php?id=72841#ixzz27wuhAqCc

What I believe this article is saying is that banks in Iraq were gouging the people on the value of the dollar which led to a decline in the street value of the dinar against the dollar. When the central bank bought dinars with dollars that seemed to bring the dollar's value down and the dinar's value back up as supply and demand did their thing. If you don't understand that there are two markets for currency in Iraq you won't understand these articles. The official value (which is the value of the IQD that investors hold) wasn't affected. Only the street value was.

Of course some of the gurus completely misinterpreted this article and focused on the fact that the CBI was manipulating the exchange rate and said that this confirms that they're hiding the true value. Rubbish! They were just managing the market value which is something they've done for years. The gurus focused on the words "would make dollar equals Iraqi dinar per the next few days". I believe that this is just referring to the CBI's success in bringing the street exchange rate closer to the official exchange rate of dinar per dollar.

Which brings to mind another article from the NY Times a few years ago entitled "Billions Over Baghdad". In this article there was a reference to the appreciation of the dinar shortly after the currency was changed in 2004.

Because the new Iraqi dinar was so popular, the central bank bought billions of United States dollars to keep it from appreciating too much.

Again, the dinar is a pegged currency so it doesn't appreciate apart from the occasional adjustment by the CBI which has only occurred once since 2009. The appreciation that this article was referring to was the market price in Iraq and had nothing to do with the official value of the dinar held by speculators.

The next point in the Reuters article I'd like to address is this paragraph.

The central bank has been considering plans to knock three zeros off the nominal value of banknotes to simplify financial transactions. This would not in itself increase the real value of the dinar, since prices would adjust in line with the redenomination, but economic experts say it could improve confidence in the dinar and thus boost its value eventually.

This confirms what I've been saying about "deleting three zeros" means redenomination (lop), which yields no net increase in the value. This was also stated in the recent indictment of the four dinar pumpers who were arrested on fraud and money laundering charges. And for anybody who thinks "deleting three zeros" is a mistranslation of the Arabic reference to removing the three zero notes from circulation, bear in mind that this is a Reuters article written in English, not an Arabic article translated into English.

Next we have this.

In a memorandum to the International Monetary Fund on economic and financial policies for 2011, written in March that year, the Iraqi government said it saw benefits in keeping the dinar stable.

This confirms what I wrote recently about Shabibi and Stability. Contrary to what the gurus are telling us Iraq likes the exchange rate just like it is, and that's why it's not going up. It's not because of Maliki or Obama or the Kurds or Kuwait or China or anybody else. It's because the Iraqis don't see fit to raise it.

And finally, we read this.

Deputy central bank governor Mudher Kasim told Reuters that he expected redenomination of the dinar to go ahead in 2014 or later, by which time the amount of Iraqi currency in circulation would have increased significantly, making financial dealings in cash even harder.

As I have been saying, rather than reducing the money supply the CBI is representing the growth in their economy by increasing the money supply. The deputy governor of the CBI anticipates further increases over the next year or two according to the article. Also, as I suspected the currency reform apparently won't happen for another year or more. This is one reason I have decided not to spend as much time as I was on the blog. (I never said I wasn't going to post anymore as some are claiming.) I can't see myself posting three times a week for the next year or two like I've been doing for a year now. In fact I was just going to stop posting entirely unless something significant occurred. Well wouldn't you know it? Right before the one year point of my blog the arrests took place. How could I not post on that? And I now anticipate more developments.

I had been told recently that something significant was about to happen with investigations of dinar fraud, but I dismissed it just like all of the other dinar rumours I hear. In this case however the rumour proved to have substance. Now I am told to expect further movement along these lines so I might have to put my blogging hiatus on hold. Nothing would make me happier, I assure you.

.jpg)

This and another news article that was out yesterday explained VERY clearly that the delete 3 zero plan was in fact a lop and not some mythical RV. But I don’t expect that to keep gurus from lying about it.

ReplyDeleteAs for the artificial rate. In this case the gurus are correct. The CBI is holding the dinar at an artificial rate of 1166. But they got it backwards. The dinar is not worth more than that, it’s worth less than that. As dozens of articles have talked about this year, the street rate of the dinar has sunk back to 1200 or higher against the dollar.

It is disappointing that they seem to have given up on redenominating in 2013, and are now talking about 2014 or later. This gives dealers another year or more to push this scam. It would be nice to see a few more indictments or a few more clearly worded statements from officials warning of this scam.

I also wonder if since the lop is pushed off to 2014, will the CBI now go forward with once discussed 100,000 dinar note?

Good stuff, as usual. In the dinar world, it's so unusual to have somebody read a document and understand it based on what it actually says. I'll bet if someone at PTR or Dinarvets came across that document, they would read it and tell everyone it is proof of the RV.

ReplyDeleteSo true networth...sad to say.

ReplyDelete@DaveD Good point about the 100K note. Most forgot about them talking about having a 50K and a 100K and it is possible until they RD, if they decide to postpone until 2014 or after, i would say highly likely they would issue these notes for easier transactions, if buying something worth say 100 USD$, instead of 4 25K notes, 2 50K or 1 100K note, etc. In any case, as the liars continue to twist facts and details to suit an overnight RV costing trillions in liability to Iraq, Iraq is going to RD or rebase eventually. That is 100% in line with history, but how the dinar has been hyped is nothing short of criminal, and the frauds will likely begin to join BHGroup and the rest, along with more than a few dealers who also were behind the deceptive promotion.

We all once bought into the hype, then we learned historical truth and how currency is managed, not by someone lying, but via history. Sad to see so many decent folks that were literally sucked into this thing by a lie, and some bought more each time they were lied to. I hope justice is served, and I also hope no more folks are hurt by this scam, but i fear many will be.

Thank you Sam for the well done break down of the article. I also think more arrests will come. At some point, the big news will be that a pumper who gets arrested will spill the beans on the dealer involvement, and expose something likely to be very ugly. There is indeed something very wrong with how the dinar even got to this point...greed and more greed with more than willing buyers unfortunately. My theory is simple, and that is the dealers not all, but the 'big ones' such as DT, DB, TD and maybe more were complicit and encouraged the hype. I suspect this will come to light soon. I hope _before_ they get a chance to dupe more folks with the typical end of year bonanza and gouging.